Car depreciation calculator excel

Base value of the asset x days asset owned365 days x 200 effective life of the asset. To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc.

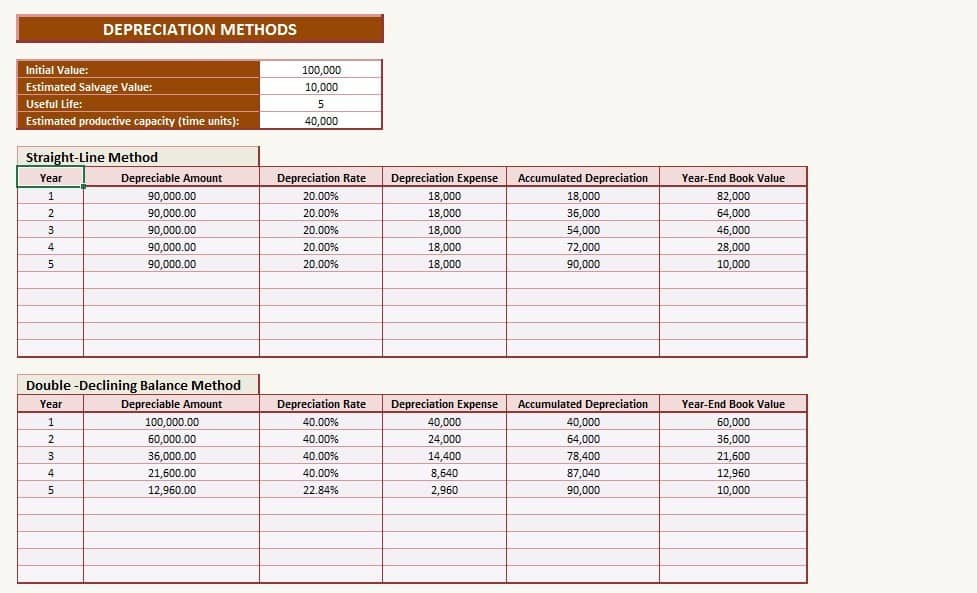

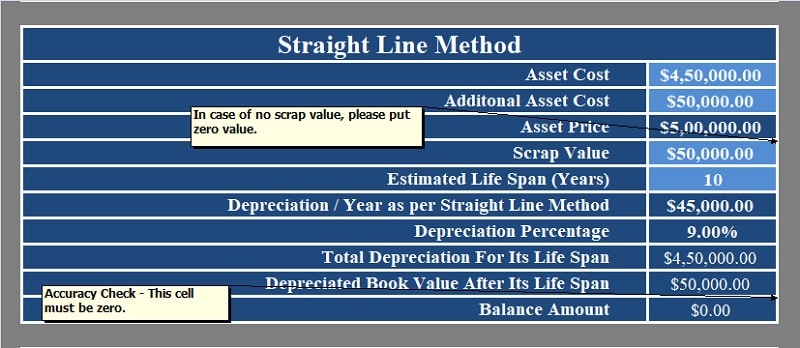

Depreciation Schedule Template For Straight Line And Declining Balance

Use Depreciation Calculator to calculate your return value in 2022.

. You can add 100 150 and 200. By entering a few details such as price vehicle age and usage and time of your ownership we. This Depreciation Calculator can help you check your interests stock value Straight line method excel ato quarterly yearly.

Citroen 45 average 3 year depreciation. Overview of Loan Amortization. Chevrolet 55 average 3 year depreciation.

We consider an asset with an initial cost of 10000 a salvage value residual value of 1000 and a useful life of 10 periods years. Calculate Total Payment of Loan. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

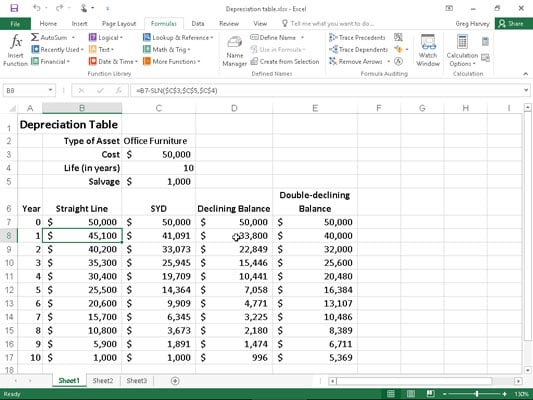

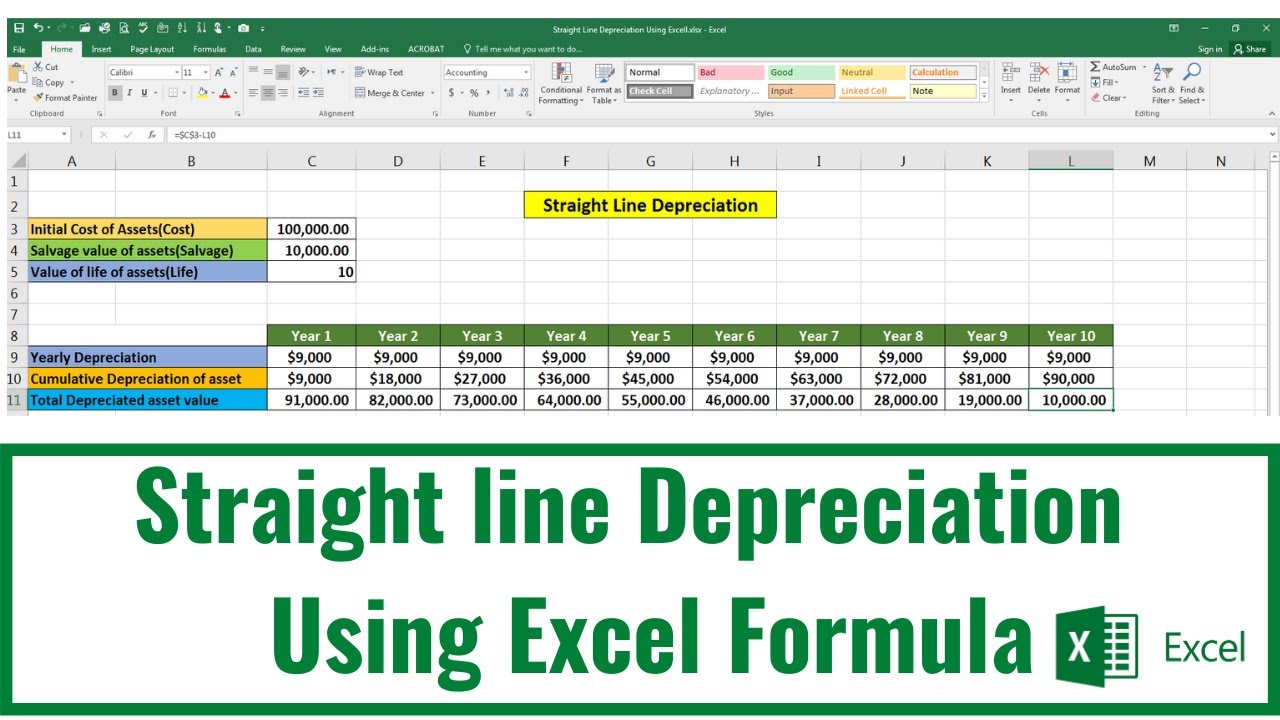

Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along. Step-by-Step Procedure to Create Car Loan Amortization Schedule in Excel with Extra Payments. It is not intended to be used for official financial or tax reporting purposes.

Dacia 25 average 3 year depreciation. Just enter the loan amount interest rate loan duration and start date into the Excel. Straight line depreciation calculator.

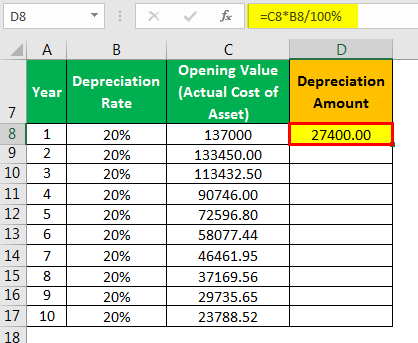

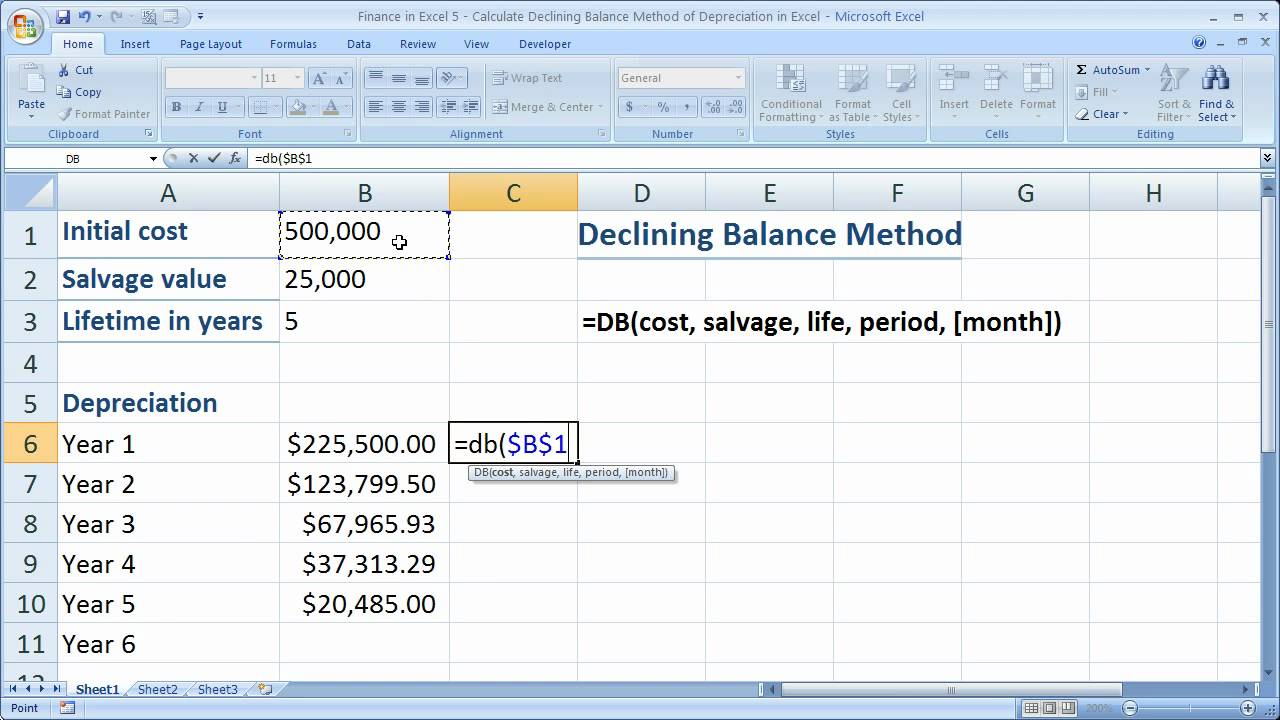

Under this method the calculation of depreciation is based on the fixed percentage of its cost. The formula to claim under diminishing value method is. Excel has the DB function to calculate the depreciation of an asset on the fixed-declining balance basis for a specified period.

Rental property depreciation calculator. The workbook contains 3 worksheets. Chrysler 50 average 3 year depreciation.

Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel. The first step is to enter the numbers and their corresponding headings in the appropriate cells. Under the variable declining balance method depreciation rate to be applied to the opening carrying balance of an asset is worked out using the following formula.

It will then depreciate another 15 to 25 each year until it reaches the five. Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value. We will even custom tailor the results based upon just a few of.

Business vehicle depreciation calculator. If you leave the. To calculate the depreciation value Excel has built-in functions.

Use this depreciation calculator to forecast the value loss for a new or used car. The function needs the initial and salvage costs. This calculator uses the same.

Excel offers five different depreciation functions. AFTER FIVE YEARS. We need to define the cost salvage and.

This new car will lose between 15 and 25 every year after the steep first-year dip.

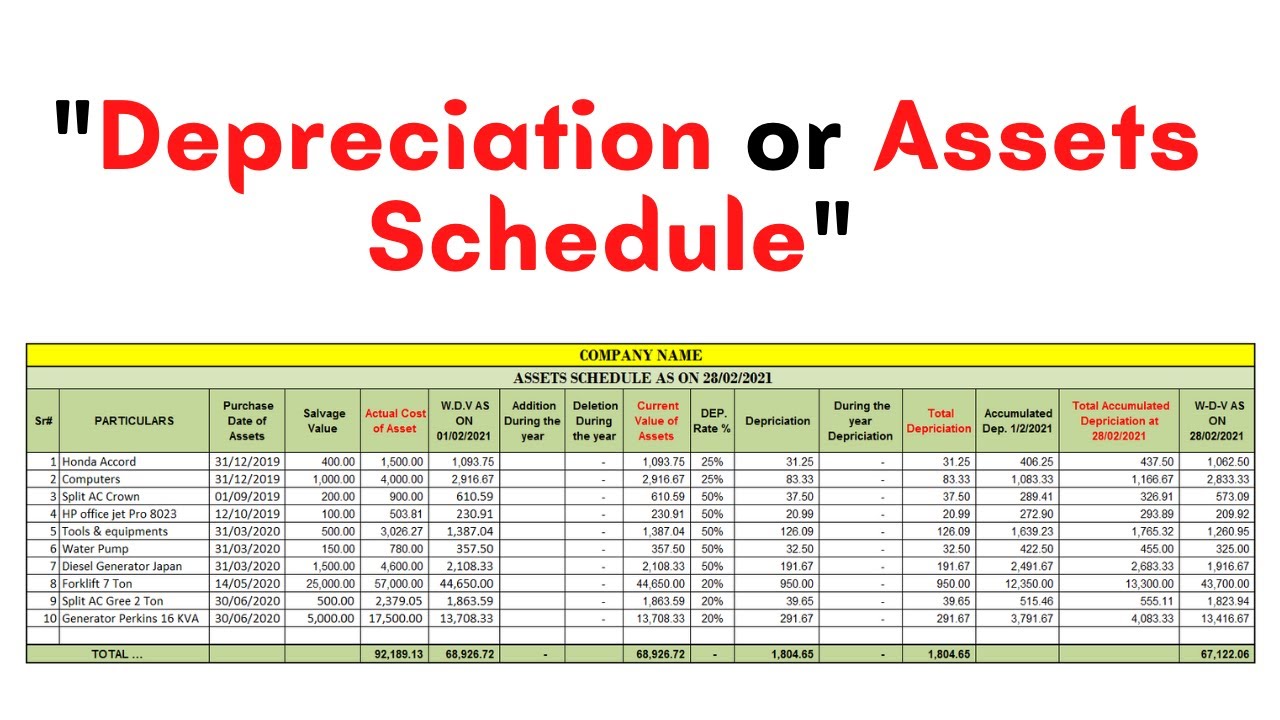

How Can I Make A Depreciation Schedule In Excel

How To Prepare Depreciation Schedule In Excel Youtube

2

Download Depreciation Calculator Excel Template Exceldatapro

How To Use Depreciation Functions In Excel 2016 Dummies

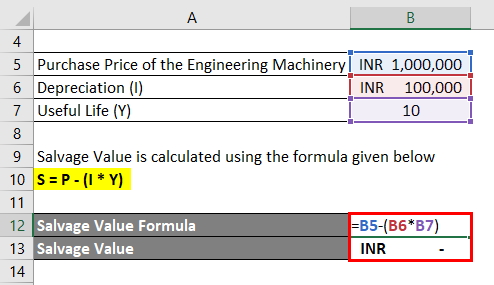

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Depreciation Calculator

Using Spreadsheets For Finance How To Calculate Depreciation

How Can I Make A Depreciation Schedule In Excel

Download Depreciation Calculator Excel Template Exceldatapro

Salvage Value Formula Calculator Excel Template

How To Use The Excel Db Function Exceljet

Free Depreciation Calculator In Excel Zervant

Sum Of Years Depreciation Calculator Template Msofficegeek

How To Prepare Depreciation Schedule In Excel Youtube

Finance In Excel 5 Calculate Declining Balance Method Of Depreciation In Excel Youtube